33+ 80k deposit how much can i borrow

This ratio says that. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643.

Complete Quantitative Aptitude Questions Complete Quantitative Aptitude Questions For Sbi Ibps Pdf Area Volume

Things you should know.

. Work out 30 of that figure. If you qualify for an 80000 personal loan at 499 with a 12-year term you can estimate about a 740 monthly payment. You also have to be able.

Get an estimate in 2 minutes. If they wanted to buy the 300000 house they would have to find a deposit between 100000 33 and 180000 60 to make up the difference between what they can borrow. The MIP displayed are based upon FHA guidelines.

The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. For this reason our calculator uses your. If you want a more accurate quote use.

If you use a lender with no early payoff penalty you can pay your loan. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Please note that there are temporary restrictions on our deposit requirements which may mean.

Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances. Heres how a difference in your assumed property price and lender valuation can affect the deposit you need. FHA requires a 35 down payment as well as an upfront and monthly mortgage insurance in many cases.

You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details. It is not an offer of finance from Westpac New Zealand. Calculate how much you can borrow to buy a new home.

5 Deposit Calculation for a. I am considering buying this 700000 house in SA but I want to know how much I. Your salary will have a big impact on the amount you can borrow for a mortgage.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. This affordability calculator is intended as a guide only and is based on the limited information provided by you. Thats a 120000 to 150000 mortgage at 60000.

Other loan programs are. Call 0800 269 4663 to talk to an ANZ Home Loan Coach Visit an ANZ branch. Divide by 12 to get a monthly repayment.

Take your annual income. Use our range of mortgage calculators to work out how much you could borrow how large a deposit you will need for a mortgage and if you are overpaying. How Much Can I Borrow.

Find out how much you could borrow. I have been working as a technical consultant for last five years and I earn around 80000 pa. So a very quick way to work out what you can afford to borrow is to.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and.

32 M 32 F Is Anyone Else Not Contributing To Their Rrsp R Personalfinancecanada

Complete Quantitative Aptitude Questions Complete Quantitative Aptitude Questions For Sbi Ibps Pdf Area Volume

2

Complete Bank Exams Guide Pdf Speed Royalty Payment

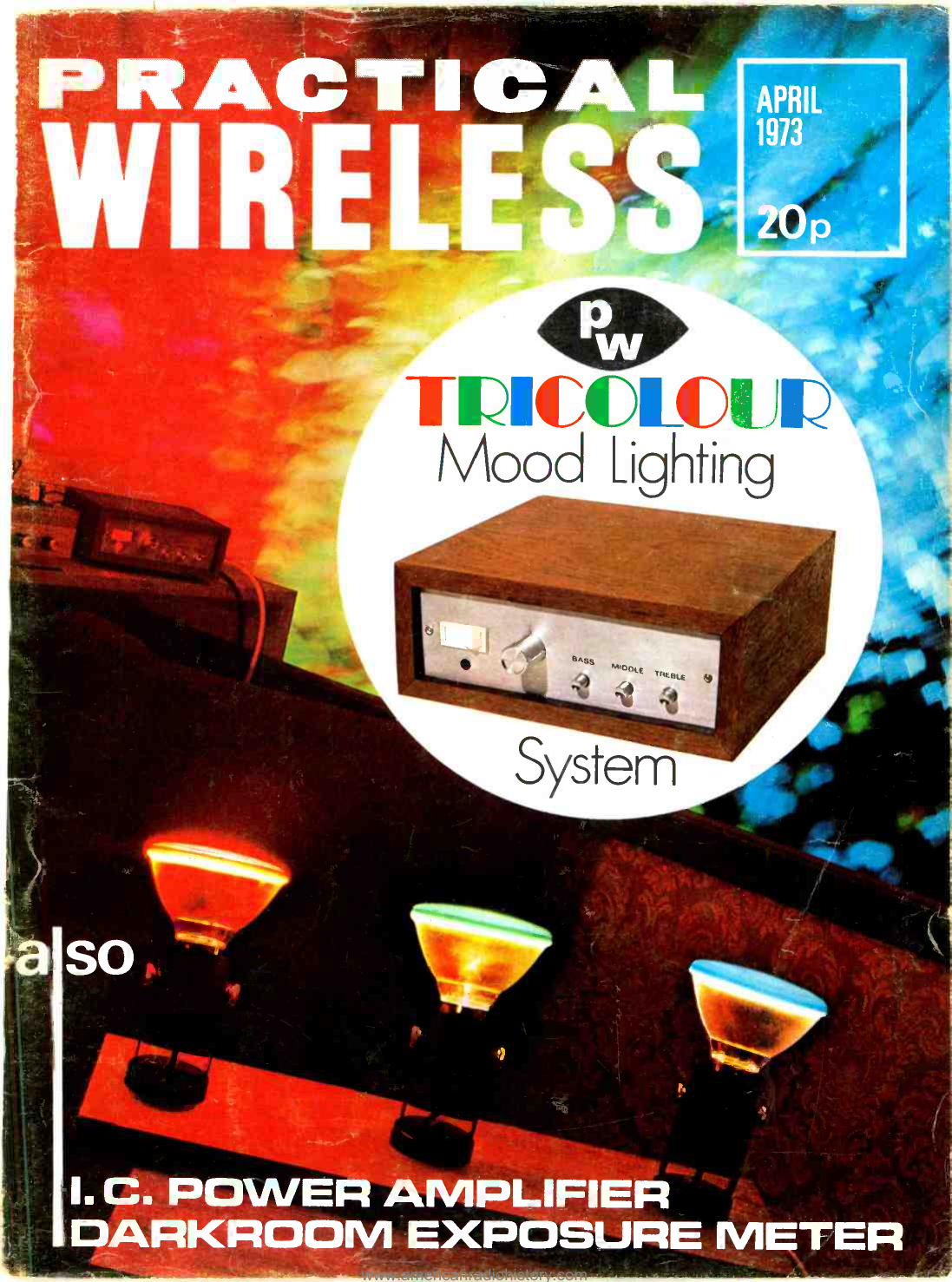

Ic Power Amplifier American Radio History Manualzz

Complete Quantitative Aptitude Questions Complete Quantitative Aptitude Questions For Sbi Ibps Pdf Area Volume

Complete Quantitative Aptitude Questions Complete Quantitative Aptitude Questions For Sbi Ibps Pdf Area Volume

Complete Quantitative Aptitude Questions Complete Quantitative Aptitude Questions For Sbi Ibps Pdf Area Volume

Complete Quantitative Aptitude Questions Complete Quantitative Aptitude Questions For Sbi Ibps Pdf Area Volume