Net pay calculator indiana

Find the best CD rates by comparing national and local rates. If you make 70000 a year living in the region of Indiana USA you will be taxed 10616.

Indiana Paycheck Calculator Adp

Own Your Future.

. 6 to 30 characters long. Accurate reliable salary and compensation comparisons for United States. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

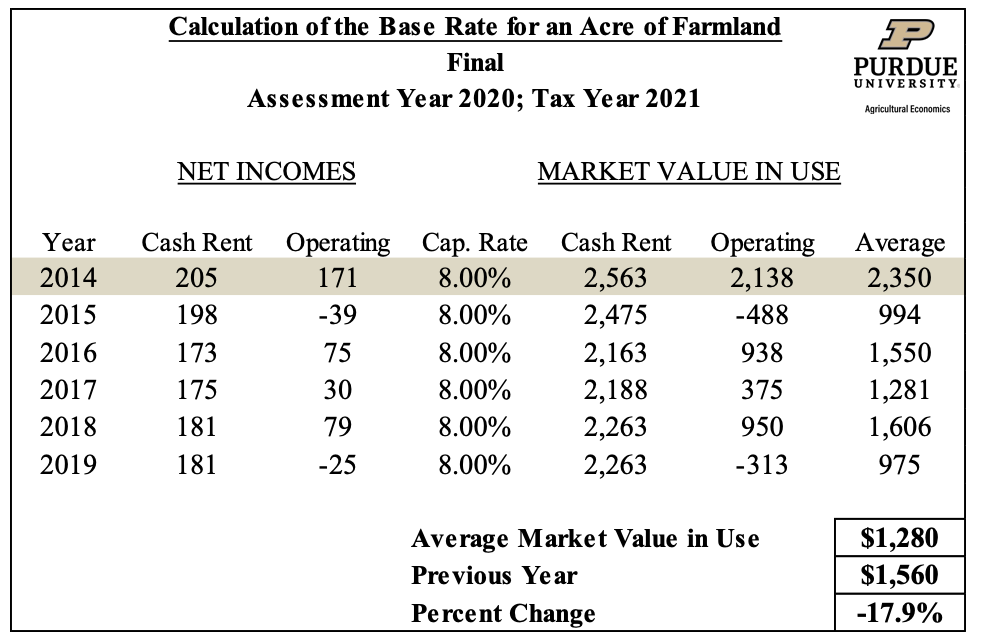

Hire employees with disabilities. How Property Taxes Work in Indiana. As in most other states the Indiana property tax is ad valorem meaning its based on the value of property.

You have a 14-day grace period to pay unpaid tolls. You can pay tolls on Chicago Skyway Toll Plaza using cash credit cards and E-ZPass or I-PASS toll tags. GTMs nanny tax calculator should be used solely as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations.

The College Boards Net Price Calculator NPC lets institutions give prospects an estimate of what theyll pay to attend their college. It is NOT a financial assistance offer. Pay on specified dates twice a month usually on the fifteenth and thirtieth.

Switch to Indiana hourly calculator. Illinois toll calculator calculates tolls and gas expenses for. Taxes can be divided into two annual installments with one being due on May 10 and the other on November 10.

The net present value calculates how much you would need to invest now in a risk-free investment to. No one likes surprises when it comes to their tuition. Give us a call 844 937-8679.

Must contain at least 4 different symbols. Pay each week generally on the same day each pay period. Refund Transfer is a bank deposit product not a loan.

Texas Paycheck Calculator Calculate your take home pay after federal Texas taxes Updated for 2022 tax year on Aug 02 2022. Convert Gross and Net Pay. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. You can file your return and receive your refund without applying for a Refund Transfer. Quickly find it with TaxActs simple tax bracket calculator up to a salary of How did we calculate Federal Tax paid on 66000 For example if an employee is paid 1500 per week his or her annual income would be 1500 x 52 78000 Severance pay is considered part of an employees income and is fully taxed based on the employees tax.

Buy assets and equipment. Based on the information provided in the net price calculator the following represents an estimate of net price of attendance at Oakland University. Free auto loan calculator to determine the monthly payment and total cost of an auto loan while accounting for sales tax fees trade-in value and more.

Net Price Calculator Results. What you see is what you pay and save. A qualifying expected tax refund and e-filing are required.

Payroll check calculator is updated for payroll year 2022 and new W4. Located on a beautiful 1400-acre campus in Evansville Indiana USI offers programs through the College of Liberal Arts Romain College of Business College of Nursing and Health Professions and the Pott College of Science Engineering and. Pay 2 times a year.

Thats why we offer affordable upfront pricing. Your average tax rate is 1198 and your marginal tax rate is 22. This marginal tax rate means that.

If your parents are divorced or separated each parents contribution is assessed separately. An employee received a pay raise of 115 an hour by the owner but the owner forgot to inform the payroll department. The employee will need the difference paid as retro pay for the 40 hours in the prior period back to the date the raise.

I-Pass allows you to save up to 50 on tolls. Convert Salary to Hourly Rates of Pay. Bankrate compares thousands of financial institutions to make it easy for you to apply for the best certificate of deposit rate.

The University of Southern Indiana enrolls over 11000 dual credit undergraduate and graduate students in more than 100 areas of study. How should I fill out the Net Price Calculator if my parents are divorced or separated. Expand to new locations.

Total of 60 Loan Payments. Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you. Payroll runs the employees last paycheck using the old pay rate to calculate earnings.

Use this federal gross pay calculator to gross up wages based on net pay. Indiana University - Bloomington. What you would pay to attend Harvard.

For a married couple with a combined annual of 106000 the take home page after tax is 88690. Easily calculate the take-home Net pay to the employee from a total Gross amount and vice versa. Real estate owners in the state of Indiana must pay taxes on their property every year.

The Indiana Toll Road and in 17 other states via the E-ZPass system. The take home pay is 44345 for a single filer with an annual wage of 53000. Cost of attendance financial assistance availability and awarding criteria change every year.

ASCII characters only characters found on a standard US keyboard. Pay on a specified day once a month. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates.

Merge and acquire businesses. Thats why some very rich Americans dont pay as much in taxes as you might expect. Pay every other week generally on the same day each pay period.

If ownership of the income and principal is split one must calculate the net present value of all future payments from the trust to the beneficiary. United States - Get a free salary comparison based on job title skills experience and education. What people are saying.

Close or sell your business. Each parent should use the calculator to obtain an estimated cost for their personal income and asset information. Become a federal contractor.

Pay 4 times a year. Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana paycheck calculator.

Indiana Income Tax Calculator Smartasset

2022 Best Places To Live In Indiana Niche

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

Indiana Paycheck Calculator Smartasset

Indiana Paycheck Calculator Smartasset

Indiana Military Installations Contact Information The Official Army Benefits Website

Marketing In The Era Of Digital Technology Pinterest Business Model Canvas Business Model Canvas Pinterest Business Model Business

Farmland Assessments Tax Bills Purdue Agricultural Economics

Essay Info Fafsa Essay Student

Indiana Teacherpensions Org

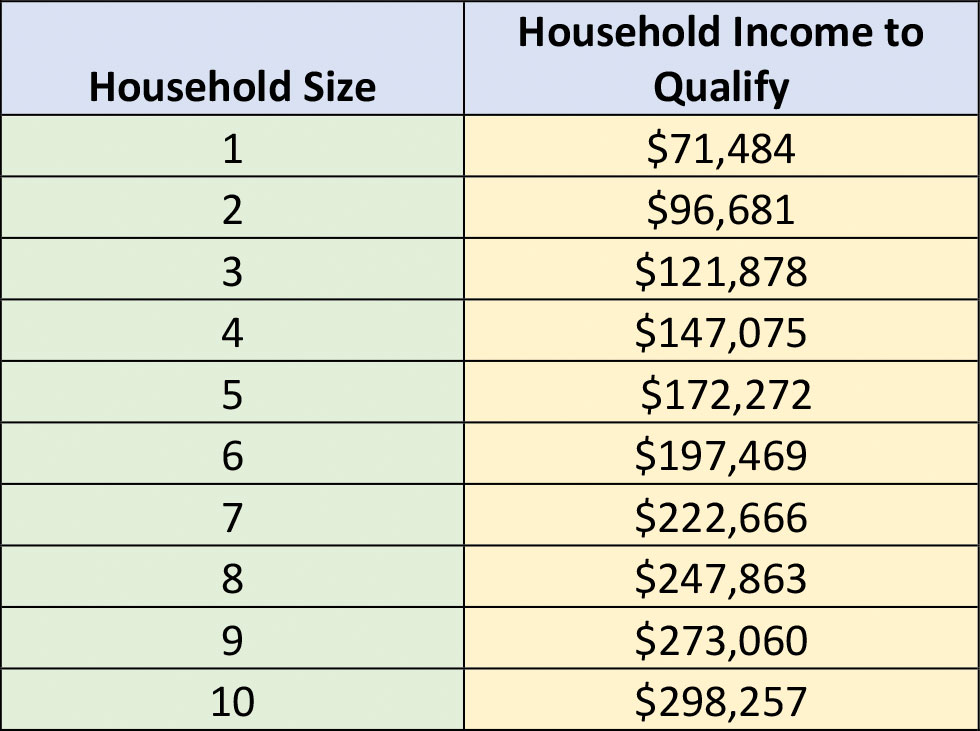

How To Qualify For The Indiana Choice Scholarship Program July 30 2021

Alumni Association Indiana State University

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

Indiana Plumbing License How To Become A Plumber In Indiana

The State Of The State Illinois Wall Of Shame Infographic Business Jobs Education

Indiana Map Map Of Indiana Indiana Maps Collection Indiana Map Time Zone Map Map

Indiana Paycheck Calculator Adp