Net cost plus margin

Net profit margin net profit revenue x 100. The transaction is for a product sale where the direct cost of the product is 50000.

The Transactional Net Margin Method Explained With Example

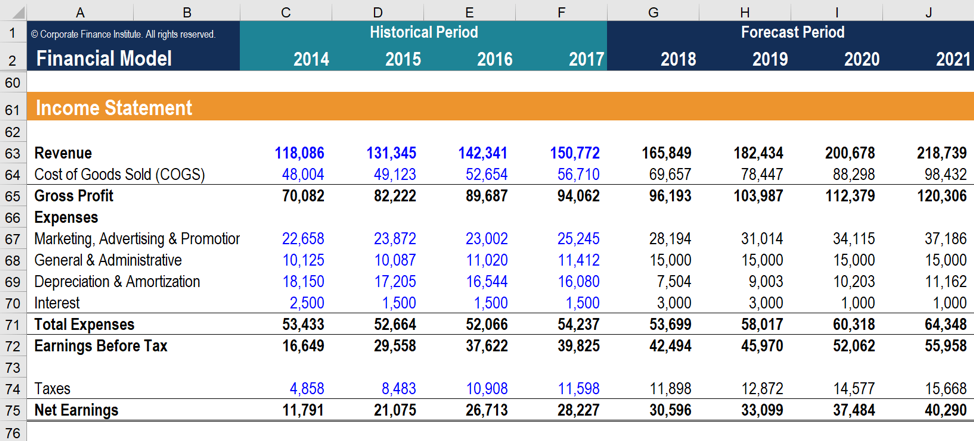

To calculate your profit margin you first need to calculate your net income and net sales.

. Net profit revenue cost of goods sold operating expenses interest taxes. And examines the net profit margin relative to an appropriate base such as costs sales or assets. If she used FIFO the cost of machine D is 12 plus 20 she spent improving it for a profit of 13.

The Net Cost Plus Margin is the ratio of operating profit to total cost. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The net income will be reported on Line 2 of Form 1120.

Net margin includes taxes interest paid on debts and indirect expenses such as administrative costs. Microsoft Net Profit Margin 17681 60420 2926. Your cost of goods is 300000.

This is the operating profit divided by net sales. The gross margin for the quarter contracted 100 basis points to 109. Calculating the Net Profit Margin of Microsoft.

Michelle Branch Addresses Domestic Dispute With Husband Patrick Carney The singer whose new LP drops this week discussed the recent drama in a series of interviews. X 100 Net Profit Margin. It also refers to the amount of equity.

Annual cost-of-living bump could be biggest since 1981 but may be smaller than many had hoped amid stubbornly high inflation. Here is an example of the profit margin formula at work if total revenue is. Net profit margin is used to calculate the percentage of sales revenue that remains as true profit after all costs and expenses are accounted for.

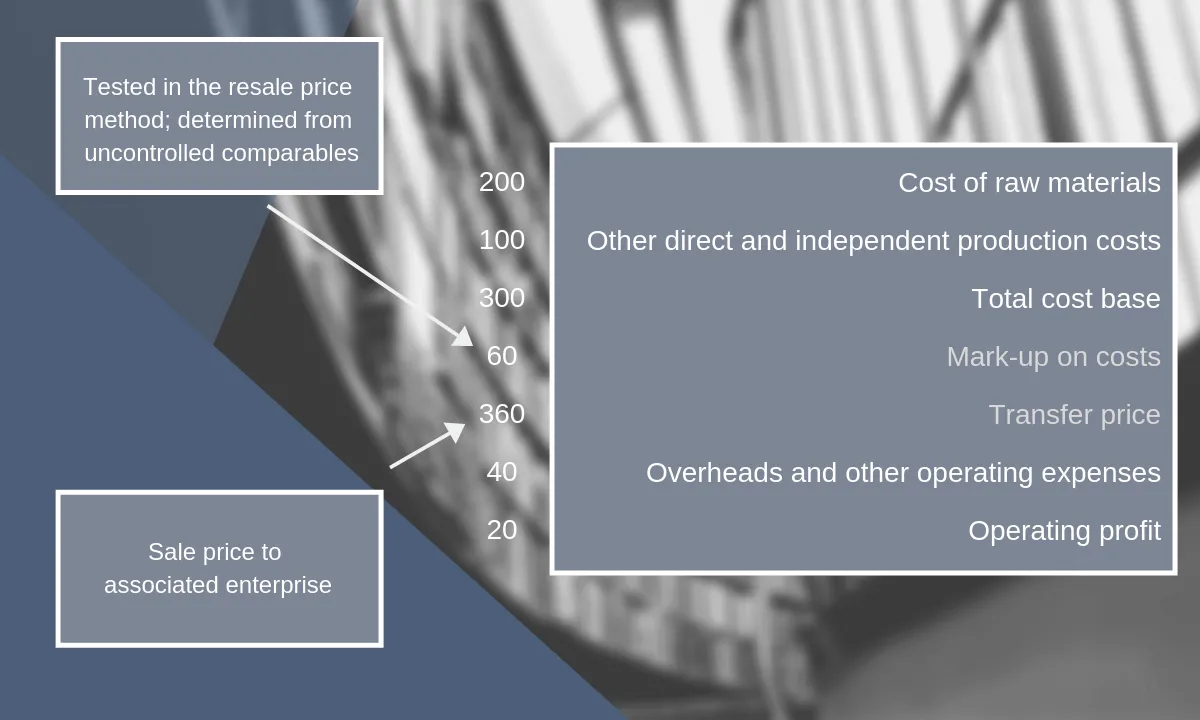

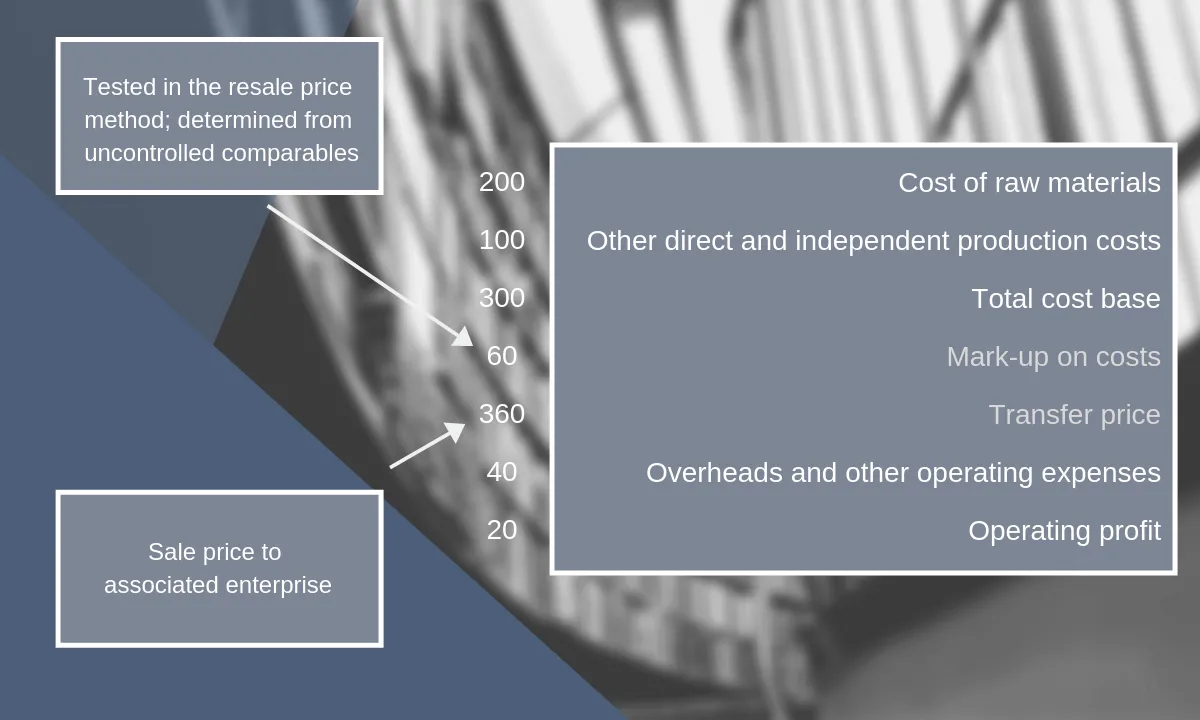

This differs from the cost-plus and resale. As opposed to the gross margin the operating margin also takes operating expenses into consideration which are various expenses related to general administrative and sales functions of a company plus production. The key difference between gross margin and net margin is that net margin equals revenue after all expenses have been deducted.

In the first resort the risk is that of the lender and includes lost principal and interest disruption to cash flows and increased collection costsThe loss may be complete or partial. Net margin Net income. EBITDA stands for earnings before interest taxes depreciation and amortization.

6 to 30 characters long. Form 8915-F replaces Form 8915-E. It acts as a measure for the amount of net income or net profit a business makes per dollar or pound of revenue earned.

The cost of goods sold will be calculated on Form 1125-A. Remember she used up the two 10 cost items already under FIFO. I Slapped My Husband.

EBITDA - Earnings Before Interest Taxes Depreciation and Amortization. After that plug your variables into the net profit margin formula. Originally located in the Los Angeles suburb of Culver City California the league invested 100 million to fund the networks operations.

Get 247 customer support help when you place a homework help service order with us. Net profit margin Net profit is what remains after you deduct COGS OPEX interest and taxes. Semiannual annual and less often at other periods.

Must contain at least 4 different symbols. Since net profit margin is a ratio we dont have to worry about the last 6 zeros so we find that. The cost of goods sold will be calculated on Form 1125-A.

The formula is net sales - cost of goods sold net sales. 92000 Net revenue - 52000 Variable expenses 40000 Contribution margin. If she uses average cost it is 11 plus 20 for a profit of 14.

Vehicle margin contracted 190 basis points to 91 mainly attributable to the battery cost increase. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Based on this information the contribution margin is.

ASCII characters only characters found on a standard US keyboard. Net Income from Continuing. NFL Network was launched on November 4 2003 only eight months after the owners of the leagues 32 teams voted unanimously to approve its formation.

This number is always less than the gross margin. Partnerships and multiple-owner LLCs. In 2019 ABC Ecommerce generated 800000 in annual revenue.

Get 247 customer support help when you place a homework help service order with us. EBITDA is one indicator of a companys. A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments.

Get access to 40 years of historical data with Yahoo Finance Plus Essential. The formula for net margin is as follows. In an efficient market higher levels of credit risk will be associated with higher borrowing costs.

For its fiscal year 2008 Microsoft MSFT earned net income of 17681000000 on 60420000000 of total revenue. Her cost for that machine depends on her inventory method. How to calculate net profit margin.

The net income will be reported on Line 2 of Form 1120S. NFL Films which produces commercials television programs and feature films for. Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022 as applicableIn previous years distributions and repayments would be reported on the applicable Form 8915 for that years.

What is net profit margin. Find your net profit using this formula. As Operating profit usually Earnings before Interest and Taxes is used or simply EBIT Total cost means the direct and indirect operational costs without extraordinary items.

The salesman who completed the deal will receive a 2000 commission so the aggregated amount of all variable costs is 42000. In finance a bond is a type of security under which the issuer owes the holder a debt and is obliged depending on the terms to repay the principal ie. Once youve identified your net income and net sales you can use the profit margin formula.

If she used LIFO the cost would be 10 plus 20 for a profit. Margin is the difference between a product or services selling price and its cost of production or to the ratio between a companys revenues and expenses. Your net income was 250000.

The transactional net margin method TNMM in transfer pricing compares the net profit margin of a taxpayer arising from a non-arms length transaction with the net profit margins realized by arms length parties from similar transactions. Total expenses include the cost of goods sold COGS plus all the other costs of running your business like operating cost payroll and taxes. The net profit will be reported on Line 2 of Form 1065.

Amount borrowed of the bond at the maturity date as well as interest called the coupon over a specified amount of timeThe interest is usually payable at fixed intervals.

Strategies For Increasing Your Markup Remodeling

The Five Transfer Pricing Methods Explained With Examples

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

How Profitability Metrics Measure Earnings Performance Margins

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

The Five Transfer Pricing Methods Explained With Examples

The Five Transfer Pricing Methods Explained With Examples

The Transactional Net Margin Method Explained With Example

The Five Transfer Pricing Methods Explained With Examples

Transfer Pricing Methods Crowe Peak

The Transactional Net Margin Method Explained With Example

Transfer Pricing Methods Crowe Peak

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

How Do Gross Profit Margin And Operating Profit Margin Differ

Net Profit Margin Definition How To Calculate It Tide Business

Transfer Pricing Methods Royaltyrange

Net Profit Margin Definition How To Calculate It Tide Business